Many new businesses may make the mistake of limiting their payment options, such disallowing credit cards in favor of options such as bank transfers, cash, etc., for immediate cash flow and lower processing fees. While it may save the business some cost at the start, this will inevitably turn away customers who are unable to pay with their preferred method.

In fact, studies have shown that shoppers unable to pay with their preferred method are at high risk of cart abandonment. Not only that, a whopping 56% of them may never return to the site.

Globally, more than 40% of customers prefer to pay with a credit card. As paying with credit cards is safe, easy, and quick, it has become one of the most popular methods of payment, especially for online businesses. In this article, we’ll cover some of the reasons why businesses should always accept credit cards as a rule of thumb, as well as some best practices in doing so.

1. Getting Larger Cart Sizes

Credit card purchases are more likely to result in larger cart sizes than direct payments such as bank transfers. In general, businesses tend to see a 20% increase in sales when they offer the ability to pay with credit cards. Customers tend to prefer using credit cards for convenience, and will consolidate most of their purchases with credit cards for convenience, the ability to delay cash flow, and reward points.

Offering credit card purchases will likely be a key deciding factor in converting these customers, as they will likely decide against making large purchases if they are unable to get reward points or a cash flow delay.

2. Credit Cards Are Safer and More Secure

Ensuring a positive shopping experience for your customers is important if you want them to make repeat purchases with you. For customers, a big advantage of using a credit card for online purchases is their in-built fraud protection. This means that shoppers can easily stop purchases or even cancel their card altogether in the case of fraud.

Especially for first-time customers, allowing them to pay with their credit card will provide them with a sense of security, as opposed to only offering direct payment options before you have proven yourself to them as a reliable and trustworthy business.

3. Improve Buying Experience

When you’re buying a product, will you want to be directed to multiple different pages and sections to complete your purchase? Chances are the answer is no.

If your customer is able to complete their purchase from a single page, as with the case for most credit card purchases, this reduces the time it takes to buy and is a positive buying experience for the customer.

This inevitably leads to our next point.

4. Reduce Friction in the Sales Funnel

Any good marketer will tell you that making the user experience as smooth as possible, with as few steps and interruptions as possible (if at all), is always better. Making your payment process complicated by redirecting your customers away from your site (in the instance of bank transfers, invoices, etc.,) will often result in dramatically decreased conversion rates.

If you’re able to consolidate payment on your site by offering multiple payment methods, chances are that your happy customers will increase their cart sizes and frequent your site more.

Best Practices

1. Choose a Trusted Payment Provider

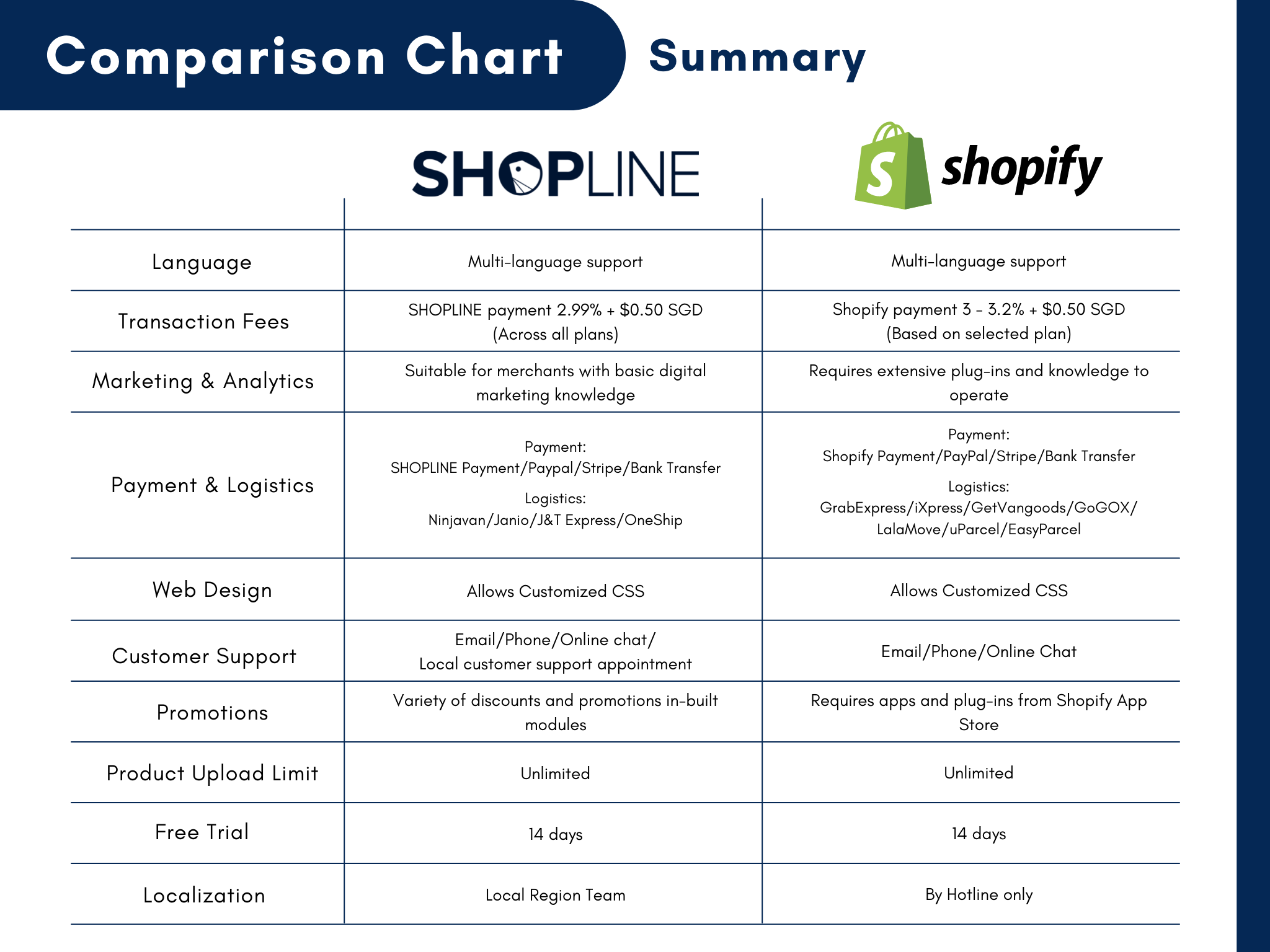

Business owners may also be daunted by the perceived hassle of setting up credit card payments for their store. However, if you’re using an eCommerce solution such as SHOPLINE, you won’t have to worry about setting up a merchant account or choosing an eCommerce payment provider system. Such platforms have built-in payment processors and most accept all major credit cards.

This makes it easier to sign up for credit card payment options, and there are fewer fees to pay. Within SHOPLINE, we offer a variety of credit card payment options like SHOPLINE Payments, Stripe and Paypal

2. Decide How You Would Want to Handle Transaction Fees

Many merchants may be put off by transaction fees levied by credit card companies which can potentially eat into their margins. However, many businesses work around this by either passing the processing fees to customers should they pick it as their desired payment option (learn more here), mark up the price of the product slightly to account for the fees, or split the fees with their customers.

At SHOPLINE, we boast a low payment processing fee of 2.99%, which allows you to offer the best prices to your customers without significant impact on your margins. Learn more about SHOPLINE’s payment processing options here.

See how SHOPLINE’s credit card fees (and other features) stack up against Shopify’s

3. Look into Local Payment Trends

Take a look at the local payment trends happening in the market and add additional payment options for your customers to select from. It never hurts to have additional payment options made available. At SHOPLINE, we provide Paynow integration through OMISE. Check out our guide on easily setting up your eCommerce payment methods here.

Conclusion:

Making the customer journey as smooth as possible is the key to success in every eCommerce business. This is especially true for the checkout process, where payment options offered to customers can be a huge deciding factor in finalizing the purchase. When creating an online store, having multiple payment options is a great way to accommodate a diverse range of customers and ultimately reduce cart abandonment.

Apart from our own payment gateway, SHOPLINE also has integrations with international payment gateways such as PayPal, Stripe, Omise (for integrated Paynow). And with secure payment gateways, SHOPLINE Payments supports 3D verification and is in compliance with PCI DSS standard. Learn more about SHOPLINE and its payment options here.